Acquisition a home (and also bundle your insurance coverage). This is one more one of those things that's a great indicator of someone ending up being a boring, responsible grownup, and also insurance provider love uninteresting, accountable adults due to the fact that they make great clients. If you're on the fencing concerning acquiring a home, below's my debate for that.

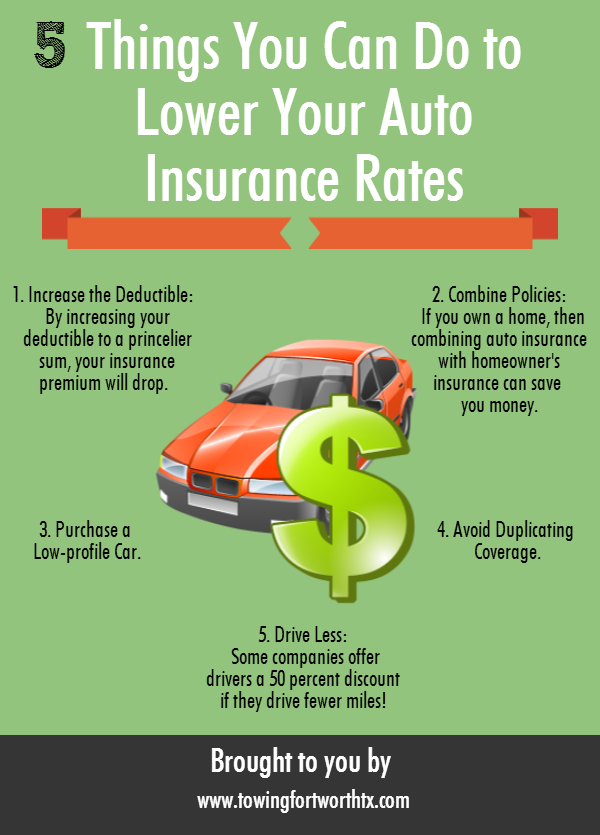

7. Drive much less commonly & lower your annual mileage. Along with the car you drive and the insurance policy you purchase, there are some basic things you can do that make insurance agents actually wish to toss money at you like you're their favored stripper. Driving much less is just one of these things.

When you're not in your vehicle, you're not a threat to your insurance firm also if you're the worst driver on the planet (credit). My insurance coverage is based upon the most affordable tier of miles took a trip each yearless than 5,000 as well as I save a boatload of money for it. This is because your odds of being in an accident boost, obviously, as you drive much more miles.

I do not recognize just how much you can save (or be dented) based on your credit rating, however the prescription for a lower insurance coverage expense is clear: enhance your credit rating and reapply. Try coming to be an extra mindful driver!

10 Easy Facts About Michigan Auto Insurance Changes On July 1: How To Lower ... Explained

Would not you be? Would certainly you allow your friend obtain your new automobile for 5 years without getting an insurance plan that would replace it if they collapsed? If you rent your car, no leasing agent is going to allow you drive their car around without an assurance that they won't need to pay anything to replace it (cheapest auto insurance).

insurance company insurance company insurance affordable low cost auto

insurance company insurance company insurance affordable low cost auto

11. Pre-pay your plan as much as feasible. Everyone understands insurance coverage agents like money and also stats just a bit greater than the remainder of us. As well as that's why they understand that money today is worth greater than money in the future, and they want to give you a sensible price cut to obtain their hands on it now.

Demand every discount feasible. Every insurance policy firm has a washing checklist of obscure discounts you may qualify for yet they do not do a whole lot of advertising for. Right here are some common ones you can ask your representative concerning:: Some occupations like policeman, firemen, physician, dental practitioner, registered nurse, and also teachers certify for unique discounts since they often tend to drive less and/or take less threats.

: Were you ever in a society or sorority? Participant of your state's bar or any type of various other professional group? There might be a discount rate for you. Ask for it!: It costs cash to stuff and mail envelopes, and some insurance coverage companies will certainly provide you a discount rate if you go with paperless statements.

Rumored Buzz on 15 Tactics To Lower Your Car Insurance By Thinking Like An ...

Just call them up and also ask, "Hey, what are all the possible price cuts I could certify for?" They more than happy to inform you. 13. Get wed! Insurance provider love wedded pairs because wedded individuals are most likely to settle and also drive like monotonous people. Likewise, married couples often tend to have kids.

1/3 of all traffic associated fatalities annually are under 25-years-old. That is escape of proportion to the general populace, so insurance coverage companies are banking on you killing yourself or somebody else with a vehicle. And website traffic deaths aren't just awful, they're crazy costly! Luckily, the stats start to level at 25, so if you can make it that long, you'll delight in lower insurance policy rates from every insurer (vehicle insurance).

Relocate to a country area. There are great deals of reasons to live outside the city, and also one rather excellent one is that you're less most likely to smash your cars and truck right into somebody else's.: Your insurance coverage price is based virtually entirely on populace stats. And where there are fewer people driving about, there are less possible collisions.

I've mentioned Gabi a few times now. Now obtain out there as well as get that inexpensive cars and truck insurance, you wizard!.

The Ultimate Guide To How Can I Lower My Car Insurance? - Quora

insure affordable car insurance car insurance cars

insure affordable car insurance car insurance cars

auto insurance trucks perks cheaper car

auto insurance trucks perks cheaper car

Multiple Cars And Trucks and/or Motorists May Conserve Money Whenever you most likely to your favored grocery shop, you'll generally obtain a better bargain purchasing several loaves of bread as opposed to simply one. The same logic puts on car insurance coverage. Normally, you'll finish up with a higher quote to insure a single car as opposed to guaranteeing numerous cars and trucks and/or drivers.

Usually, numerous chauffeurs have to live in the very same household as well as be associated by blood or marriage. If you have a teen driver, you can anticipate your insurance coverage rate to raise since young adults are a greater liability behind the wheel.

Do not Obtain Into a Mishap It appears like a noticeable suggestion, but it's one that's worth pointing out time as well as time again. Whether you obtain right into a fender bender or severe vehicle accident, crashes have a direct impact on your vehicle insurance price.

Here are some points you can do to keep yourself and also various other chauffeurs around you risk-free: Stay clear of texting as well as driving. Ensure to place on the "Do Not Disturb" attribute whenever you're driving - insurance affordable. Do not eat while driving. Comply with web traffic regulations and speed up limitations. Don't drive intoxicated of medicines or alcohol.

Get This Report on How Much Does Car Insurance Cost, And How Can I Lower ...

When you register for insurance policy, the company will generally ask the amount of miles you drive per year. This is one way an insurer estimates and identifies your costs. Minimizing your driving not only helps reduce your vehicle insurance but also your carbon impact. According to the Center for Environment as well as Energy Solutions, switching to public transport could decrease your carbon footprint by 4,800 pounds every year.

It's already a demanding situation obtaining right into a crash, so do not include gas to the fire by clambering to pay your insurance deductible. 5. Choose Vehicle Safety and Protection Includes Selecting specific automobile safety as well as protection attributes can be a fantastic method to decrease your vehicle insurance price. Several newer version cars and trucks will certainly have the most up to date security as well as protection features already set up.

7. auto. Take a Defensive Driving Course Many individuals just take a protective driving course to dismiss a ticket, yet some insurance provider use discount rates anywhere from 5% to 20% if you complete a defensive driving class by yourself accord. Not every chauffeur certifies for this type of price cut.

Some states don't also enable these price cuts at all. Be sure to speak to an insurance agent prior to authorizing up for a protective driving program and also see if you're eligible for the discount rate.

The 2-Minute Rule for How To Lower Car Insurance Premiums - Farmers Insurance

cheapest car laws laws cheapest car insurance

cheapest car laws laws cheapest car insurance

If you wish to obtain an online quote or speak with a representative, Mercury Insurance policy can help you select the insurance coverage that fits your budget plan and way of living (insured car).

Auto insurance premiums can be expensive. But considering that you're called for to carry insurance in most states, it's not a bill you can eliminate (auto). The good news is that your car insurance coverage price isn't set in stone, and a number of ways to reduce your costs are within your control. To assist you save money, below are some methods to minimize your car insurance costs.

Take Into Consideration Seasonal Driving Behaviors Are your insurance policy requires the very same year-round, or do you drive less in specific periods? Do you have a car you only drive in the summer season, like a convertible or a motorcycle!.? (vehicle). !? Use these inquiries as a starting indicate think of how your driving changes during the program of a year.

As long as you leave detailed insurance coverage on the car, it'll still be covered if it's swiped or harmed in a fire. You can not lawfully drive a car with comprehensive-only protection.

The 5-Minute Rule for 15 Tactics To Lower Your Car Insurance By Thinking Like An ...

Always restore your liability insurance coverage (and any other insurance coverage needed in your state) prior to taking your auto back on the road. You can save 10% when packing auto and residence insurance with USAA as well as up to 25% with Allstate.

Typically, the greater your insurance deductible, the reduced your costs. Nationwide approximates that if you increase your deductible from $200 to $1,000, you may conserve about 40% on your insurance premiums. If you raise your insurance deductible, ensure you have actually adequate money reserved to pay it if you require to.

Speak to your insurance agent to see if you qualify for cars and truck insurance discount rates, such as:: A terrific way to save money on your premium is to be a good driver - insurance companies. If you really did not have a relocating offense in the past three or five years, you may be eligible for a good motorist discount.

Ask about a armed forces price cut, also if you don't see one advertised (car insurance).: Teens can be pricey to insure, yet full-time high college or university pupils with at the very least a B average are usually qualified for a good trainee discount rate. If your youngster is away at college and also doesn't have a cars and truck with them, ask your representative if you're eligible for a "trainee away at institution" price cut.

More About Simple Tips To Save On Car Insurance

Look around Premiums differ from business to company, so see to it you shop around. Get quotes from several different insurance providers and also see which one offers the least expensive price. See to it you're contrasting comparable plans when you're getting quotes. Picking the most affordable car insurance without reading the small print might leave you without the insurance coverage you require.

There are points you can do to decrease your vehicle insurance coverage premiums.

You simply need to take the campaign to reduce your premiums instead of waiting for vehicle insurer to do it for you - cheap auto insurance. On that note, have a look at these six methods to lower your auto insurance policy costs in Texas. Ways to Lower Your Insurance Policy Premiums in Texas If you haven't yet done so, consider the ideas mentioned right here to see if you can reduce the amount you pay for vehicle insurance coverage.

Take a Look at Your Automobile's Added Safety and security Includes Simply like all motorists aren't dealt with the exact same for the sake of establishing car insurance coverage premiums, neither are all cars. If you have a 20-year old vehicle, it is extremely not likely that it has numerous of the security features that autos produced today have.

Not known Facts About How To Lower Your Car Insurance Rates

Take a moment to take a look at your car's manual for its security functions. Call your insurance provider and see if they have those features examined your plan. Possibilities are that this could conserve you at least a little bit of cash money in the long run. Anti-theft gadgets, for example, may decrease your bill if you reside in a risky location.

Some insurance provider focus on guaranteeing vehicle drivers who have actually come across some missteps as well as require to return Click here on their feet. Various other insurer provide to a various type of client and also aren't as welcoming of risk. If you obtain a quote that's expensive, move on to an insurance coverage service provider that might be a lot more fitting.